Facing Issues in finding out HSN Code for your product?

Under GST Enrolment, HSN Code of products being enrolled is required to be entered since turnover based HSN classification is to be introduced under GST. Taxpayers, at large, are facing challenges with obtaining right HSN codes for their products.

HSN an Overview

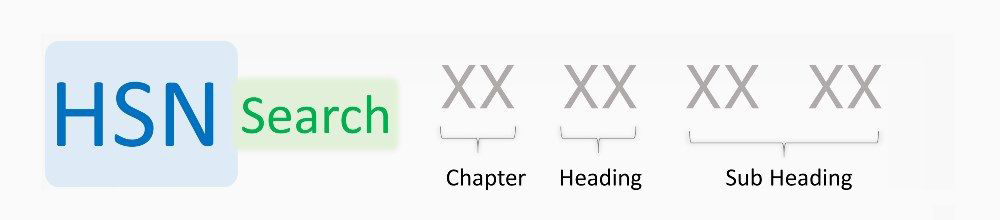

The Harmonized Commodity Description and Coding System generally referred to as “Harmonized System of Nomenclature” or simply “HSN” is a multipurpose international product nomenclature developed by the World Customs Organization (WCO).

HSN in Indian Context

In Indian Context, a taxpayer having a turnover exceeding Rs 5 crore is required to follow the HSN code of 4 digits. In return form, the rate of tax shall be auto-populated based on the HSN codes used in furnishing invoice level purchase or sale information. After completing the first year under GST, the turnover for the previous year will be considered as a baseline for using HSN codes of 4 digits. The use of HSN codes below its standards is to make GST systematic and globally accepted.

For taxpayers with turnover between Rs 1.5 Crores and Rs 5 Crores in the preceding financial year, HSN codes may be specified only at 2-digit chapter level as an optional exercise to start with. From the second year of GST operations, mentioning 2-digit chapter level HSN Code will be mandatory for all taxpayers with the turnover in the previous financial year between Rs. 1.5 Crores and Rs. 5.0 Crores. HSN code at 2 digits will be little easy for taxpayers and make GST an international compatible tax as well.

Indian authorities have further categorized six digit HSN into another two digit subchapter, thus making the total number of digit to be eight. This eight digits code will be mandatory in case of export and imports under the GST regime.

The GST law has to be compatible with international standards. The concept of HSN codes was invented outside India and same is used by various member countries.

Refer: World Custom Organization

You can find HSN code for your product/ goods from here – http://www.corpuslabs.com/gst-hsn-code-list.pdf

You can find GST rate, HSN or SAC code for your product here – https://www.indiafilings.com/find-gst-rate

Note: It is recommended to always consult your auditor or accounting specialist for acquiring and verifying the exact HSN code and GST rates for your products with the latest update.

Previous Post

Previous Post Next Post

Next Post